- Policy Analysis

- Fikra Forum

Taking Advantage of a Window of Opportunity in the KRG-Baghdad Gas Standoff

By outlining a strategy in the north of Iraq, a vision regarding reconciliation and a constructive settlement of differences between the Kurdistan Regional Government and the Federal Government of Iraq in relation to the management of energy resources in the Kurdistan Region of Iraq can emerge.

Iraq's gas reserves are estimated at 3.74 trillion cubic meters (132 tscf) in main Iraq, and 20-40 tscf in the north of Iraq and located within the Sulaymaniyah Governorate in the Kurdistan Region of Iraq (KRI). Developed in a constructive and practical way, these fields can significantly help satisfy Iraq’s North Iraq domestic energy demand. The historical underinvestment and insufficient infrastructure, coupled with strained relations between the Iraqi Federal Government and the Kurdistan Regional Government (KRG), have impeded the full utilization of these resources.

Disagreements remain between the Iraqi Federal Government and the KRG over the interpretation of Article 112 of the Iraqi constitution relating to management of resources. Despite the KRI and the Iraqi Federal Government being close to reaching an agreement in February 2007 and a draft Federal Oil and Gas law being agreed upon by all parties, the KRG at the time unilaterally chose to independently manage the resources in the KRI.

Although recently the Iraqi Federal Ministry of Oil demonstrated its flexibility in accepting the KRG’s management of the oil fields in the Kurdistan Region, the KRG’s reluctance in showing transparency over the oil contracts and the way some of the fields were developed has proved a sore point between Baghdad and Erbil and was an obstacle in the way of progress towards the settlement of their differences.

Given this backdrop, recent signs from the KRG of an increased openness towards cooperation with the Federal Government of Iraq present a unique opportunity for the collaborative development of these gas fields. There has been a significant and welcome shift in the KRG’s position since the shutdown of the Iraq-Turkey pipeline, and the KRG has accelerated efforts to settle its differences with the Federal Government of Iraq, which has reciprocated these efforts. Both sides have recently focused on streamlining the KRG’s oil contracts for acceptance by the Iraqi federal Ministry of Oil. Specifically, the prime minster of KRG recently showed interest in sending teams to negotiate and agreed in principle to parameters of the management of resources, outside of the still outstanding question of the pipeline costs per barrel.

The Federal Ministry of Oil expects to hold negotiations with the KRG as a unified body with a clear position relating to its future cooperation with the Ministry of Oil. Yet this has not always been the case, and differences remain in the vision and agendas within the KRG coalition, regarding the development of gas fields.

If and when these differences are eventually settled, significant new opportunities for constructive and highly collaborative development of the energy sector could emerge—especially in natural and associated gas—including active international participation.

Natural Gas Fields in the KRI: the Current State of Play

The majority of the gas in Iraq is associated gas, connected to the giant oil fields that are in the south of Iraq, along with the not fully developed free gas fields in Akkas in the west of Iraq and Mansouriya in the east of Iraq. While the KRI likewise has numerous gas fields, most remain undeveloped.

The Kor Mor field is the only producing natural gas field within the administrative control of the Kurdistan Region of Iraq (KRI) and is operated by an international consortium headed by a regional company. The current gas production level is at 430 mmscf, in addition to 15,000 barrels of condensate and 1000 barrels of LPG. A 180km pipeline feeds three large, combined cycle power plants, two of which are in Sulaymaniyah and one in Erbil, with a combined total installed capacity of 3,500MW. However, due to the current limitation of gas production at Kor Mor, the power plants produce a maximum of 2,000MW of electricity, whereas the KRI’s estimated energy needs are 5,500MW in winter and 7,000 MW in summer.

Expansion of the current facilities are underway at Kor Mor to increase production by 250 mmscf per day and are expected to be completed by the end of 2024. This increase should be sufficient to provide fuel to generate the KRI’s full electricity demands.

Chamchamal—a large sour gas field that was discovered in the 1930s—was also awarded to the same consortium who operates Kor Mor field by the KRG for development in 2007. However, the consortium has not developed Chamchamal and future development is unlikely in the near term given the ongoing tensions related to gas development in the KRI.

Both fields are on the border of the Kirkuk and Salahadin Governorates. The relationship between the Kor Mor gas field operator and the KRG is highly complex and volatile; the operator has won a $2.2 billion arbitration award against the KRG Ministry of Natural Resources (MNR). The main shareholders of the consortium have also been engaged in arbitration and out of court settlements against their own consortium partners. The Kor Mor gas field operator has also attempted to engage in negotiations with the Ministry of Oil to supply raw gas to North Oil Company. There is a legal issue because the Kor Mor area is a disputed area between Baghdad and Erbil rather than a KRG recognized area, and so for the federal government, buying gas from Kor Mor means buying its own gas. A further complication in such a potential scenario is that untreated gas supplied from Kor Mor would have to be delivered to North Oil Company and treated at new processing facilities that would cost hundreds of millions of dollars and it would have to sell the treated gas to North Gas Company at subsidized process, which would mean North Oil Company would incur significant losses from Kor Mor gas.

A more practical and constructive approach to benefit from the energy resources of the Kor Mor field would be for the KRG MNR to continue its direct engagement with operator of the field and for the gas to be converted to electricity within the Kurdistan Region and then transmitted to other parts of Iraq therefore indirectly benefiting from Kor Mor gas. In this way the Ministry of Oil would avoid undertaking a high-capex and long-delivery project, by North Oil Company receiving raw gas from Kor Mor and after processing it, delivering it to North Gas Company at a loss-making, subsidized price and then delivering the gas to the Ministry of Electricity at a loss. Benefiting from Kor Mor Gas-by-Wire is a much faster and more efficient way to monetise this resource through the existing private sector in the Kurdistan Region and to deliver it directly to the consumer in other parts of Iraq in the form of electricity.

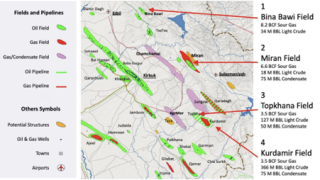

The discovered but undeveloped fields of Bina Bawi, Miran, and Topkhana are currently not under any production sharing agreements; Kurdamir is contracted to a Canadian operator and is also undeveloped. The main challenge with these fields is the high sulphur content and the requirement for capital intensive, complex technical solutions to treat and dispose of the sulphur.

The development of these fields could only be viable if the gas was used to generate electricity to satisfy domestic demand within Iraq. All these fields would be good candidates for joint development by the Federal Ministry of Oil and the KRG MNR for the benefit of all of Iraq.

The KRG has also had past successes with quickly and successfully attracting IOCs after 2006—from the very small to some of the super-majors—to explore and develop oil and gas fields in the Kurdistan Region, notably the fast-track development of natural gas, under significantly challenging conditions. Iraq could greatly benefit from expanding on this positive experience given the complicated nature of developing gas fields in the KRI.

Navigating KRG Relations with Turkey

The Turkish authorities have significant financial and political leverage over the KRG: Turkey controls seaport and land border access with Iraq directly into the KRI, as well as airspace over Turkey and therefore airspace access to the Kurdistan region. And as has been more recently demonstrated, the stop in exports through the pipeline from the KRI into has had the effect of paralyzing the KRI’s local economy. Likewise, relations between the Turkish authorities and the PUK, which controls the Sulaymaniyah Governorate where the majority of gas resources are located, have deteriorated significantly over the past two years.

Until recently, the KRG’s negotiating position with the Ministry of Oil has been disproportionately influenced by the Turkey’s national and economic interests. Turkey is interested in controlling the production of and access to the gas resources in the North of Iraq, as well as benefiting commercially from low-cost energy for its domestic needs and diversifying its access to gas sources.

However, this relationship should be re-examined as part of a re-envisioning of the KRG-Baghdad energy relationship. Iraq suffers from massive energy shortages and requires all available gas to fulfill domestic needs for the foreseeable future. Due to the high and growing domestic energy demand in Iraq, the national focus and priority should be on satisfying this demand through the development of the discovered natural gas fields as well as monetizing associated gas. Any discussion of gas exports at this stage is inappropriate until such domestic demand is met.

Exports of crude oil from the Kurdistan Region occur through the Kurdistan Pipeline Company (“KPC”) pipeline which has been built and is owned by the private sector, including significant foreign ownership. In recent negotiations between the Government of Iraq and the KRG, the clear and only significant remaining obstacle that has emerged is the economics of the KPC pipeline, which are unjustifiable. The Ministry of Oil will reject utilizing the KPC pipeline under the current terms and is considering alternative routes.

Desired Outcome

Once the remaining differences are settled and agreement is reached between the Ministry of Oil and the KRG MNR, it should be possible for the two entities cooperate closely to develop energy resources jointly through a collaborative mechanism. The priority for such collaboration should be the gas fields in the KRI: gas is urgently needed to generate power throughout Iraq, and the development of such gas fields is a complex and capital intensive undertaking that would benefit from state-backing.

There are two examples of associated gas being used for power generation. The first comes from the Khurmala field, which uses around 110 mmscfd of associated gas as fuel to produce power at the Khurmala power plant in Erbil. In addition, the KRG MNR has also been able to quickly monetize around 40 mmscfd of raw flare gas from the Garmian field that supplies a local power plant as an example of a Gas-by-Wire project, where some of the electricity is being exported to other parts of Iraq.

These two examples can help demonstrate how future projects could be jointly developed between the Federal Ministry of Oil and the KRG MNR. There are other significant associated gas opportunities from fields in the Duhok Governorate, but they are more challenging due to the high sulphur content of the gas.

Such collaboration should consider the establishment of a federal-backed but independent KRI-focused and based national energy company similar to other Iraqi regional or governorate-based oil companies. Such an entity’s activities may not be limited to oil and gas but could also include flare gas monetization and the distribution of the energy, providing an opportunity for a win-win scenario between Baghdad and Erbil.