- Policy Analysis

- PolicyWatch 3953

Gulf Energy Transition: Assessing Saudi and Emirati Goals

The energy transition in both countries includes a continued need for fossil fuels while reducing emissions—though Riyadh hopes to export “all forms of energy” down the road, and Abu Dhabi seeks nuclear advances to meet power demand.

On October 29, during Saudi Arabia’s annual Future Investment Initiative conference, Energy Minister Abdulaziz bin Salman highlighted the kingdom’s plans for adopting low-carbon sources and renewables while maintaining “preeminence” in the oil sector. Dubbed “Davos in the Desert,” the high-profile conference is one of several events that show influential regional states increasingly prioritizing economic growth and energy diversification—a long process that requires geopolitical stability for maximal effectiveness.

The Persian Gulf region is among the world’s most water-stressed and arid areas, making it highly vulnerable to climate change. Saudi Arabia, the United Arab Emirates, and other states have been investing in advanced technologies to gradually reduce emissions and meet future energy demand with different sources. Accordingly, the process of pursuing energy transition in order to tackle climate change cannot be ignored when formulating policy toward the Middle East, even at times of war. In past years, Washington invested heavily in this transition, and the next administration under Donald Trump will have further opportunities to deepen energy partnerships in the Middle East. In doing so, U.S. officials should remain mindful that key Gulf oil producers see fossil fuels as playing an important role in their energy transition plans, which are currently focused on reducing emissions rather than cutting oil and gas production.

A Transforming Energy Scene

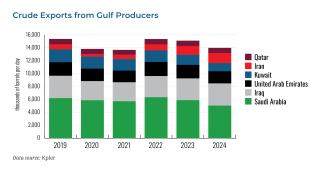

In a world that remains heavily dependent on hydrocarbons, some 35% of global seaborne oil exports and 20% of liquefied natural gas (LNG) trade originate from the Gulf. This is the energy lens through which the region is traditionally viewed. Yet while this view remains valid in many respects, it does not capture the degree to which some top producers have been reshaping their energy sectors, gradually exploring new sources and technologies that contribute to lower emissions while maintaining oil and gas investments. To fully realize this transformation, Gulf countries require not only significant funds, investments, and partnerships, but also regional stability.

As part of the 2016 Paris Agreement, countries around the world have been working to limit global warming and address the negative effects of climate change. To meet these goals, further action is required to reduce emissions of greenhouse gases such as carbon dioxide and methane. The current target is a 43% reduction by the end of this decade, reaching net zero by 2050. Some observers argue that hitting this target and addressing the climate crisis requires countries to stop new investments in oil, gas, and coal. Yet Saudi Arabia, one of the world’s top oil producers—second only to the United States as of 2023, it should be noted—believes that the transition process must encompass all forms of energy, including fossil fuels.

Key Trends in Saudi Arabia’s Transition

Riyadh’s energy transition strategy has three main pillars: enhancing energy efficiency, transforming its energy mix, and managing emissions. Its goal is to move from exporting just oil to exporting all forms of energy, as Prince Abdulaziz described at last month’s conference. New exports could include clean hydrogen produced using renewables, as well as fossil fuels coupled with carbon capture technology to reduce emissions.

In Riyadh’s view, the energy transition started in the 1970s when the kingdom implemented a Master Gas System for capturing and using the associated natural gas produced with crude oil instead of flaring it. According to the state-owned energy giant Aramco, this system helped reduce emissions by using captured gas to generate power in the petrochemical and refining industries, among other sectors.

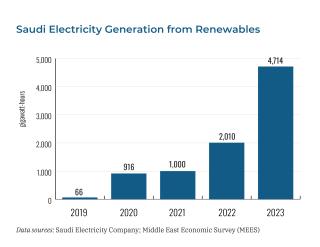

The kingdom also forecasts that renewables such as wind and solar will “contribute to approximately 50%” of its total installed generation capacity by 2030. The share of renewables in electricity generation has increased since 2022, though the power sector remains reliant on fossil fuels. The Saudis also believe that natural gas will continue to play a key role going forward. Some observers have debated whether gas has a place in the global energy transition, but proponents argue that it is less polluting than other fuels. For Saudi Arabia, gas enables authorities to reduce direct crude burning for power generation in an effort to displace liquid fuels from the power sector in the future.

Accordingly, the kingdom is investing in more gas production with the eventual goal of becoming an LNG exporter. Solar and wind are inherently intermittent sources and require advanced energy storage technologies. Until those technologies are scaled up, reliance on conventional power plants (including gas-fired plants) will continue.

As the world’s largest oil exporter, Saudi Arabia has pushed back against forecasts issued by organizations such as the International Energy Agency, which sees oil demand weakening in the next few years and peaking by 2030. In its World Oil Outlook 2050, the Saudi-led OPEC cartel offered a contrary view, projecting that global demand will reach 112.3 million barrels per day (mb/d) in 2029 and increase to 120.1 mb/d in 2050, up from 102.2 mb/d in 2023.

This bullish view has led Riyadh to bet big on petrochemicals, which are derived from oil and natural gas components and used in manufacturing products such as plastics, electrical devices, and even solar panels. Besides domestic production projects, it has sought major oil-to-chemical deals with companies in China, its top oil customer and the world’s biggest oil importer.

Oil revenues are crucial to financing this energy transformation and economic diversification—two key pillars of Saudi Arabia’s ambitious Vision 2030 plan. In August, Saudi oil revenues dropped by 6% compared to July, decreasing to $17.4 billion, the lowest monthly total since June 2021. Amid weak oil demand, OPEC+ (an expanded version of the group that includes other oil producers such as Russia) has been curtailing output to prevent prices from dropping further. The IMF recently projected that the average oil price for 2024 will be $81.29 per barrel, plummeting to $72.84 in 2025.

The UAE Expands Renewables—and Nuclear

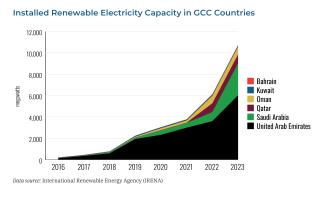

Another energy transition is happening in the UAE, which hosted last year’s UN Climate Change Conference (COP28). In the Gulf Cooperation Council (GCC) countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE—renewable energy deployment has been “concentrated” in the power sector. According to the International Renewable Energy Agency (IRENA), the UAE is leading this process, setting a 30% target for power generation from clean energy by 2030.

Nuclear energy is playing a key role in the UAE’s transition as well. The government sees the adoption of nuclear energy and renewables as essential to meet growing power demand and reduce emissions. In 2020, the first unit of the Barakah nuclear power plant in Abu Dhabi was connected to the grid; this September, the fourth and final unit began commercial operations. Barakah is now generating up to 25% of the country’s electricity needs.

In total, Abu Dhabi was generating “40% of its electricity from nuclear and renewable sources” as of March—a development that has helped slash natural gas consumption. The main driver of this shift is nuclear energy, which is regaining attention worldwide as high-tech companies (especially in the United States) look for cleaner energy sources to power their data centers with the reliable nonstop electricity they need.

In the UAE, collaboration between the high-tech and clean energy sectors has recently been explored by Microsoft, the Emirati renewable energy company Masdar, and the state-owned Abu Dhabi National Oil Company (ADNOC). On October 31, the three firms published a joint report titled “Powering Possible,” focusing on ways in which artificial intelligence can help support global efforts to expand renewable energy capacity, increase energy efficiency, meet growing power demand, and promote the adoption of “carbon-free” technologies by 2030.

Advancing U.S. Partnerships

During remarks at the Semafor World Economy Summit on October 25, senior U.S. energy advisor Amos Hochstein stated, “Most countries around the world view themselves and the world around them through the prism of economics and prosperity.” This view certainly applies in the Gulf, where existing U.S. energy partnerships have ample room for additional growth and innovation.

To promote clean energy in the region, Washington established the U.S.-UAE Partnership for Accelerating Clean Energy (PACE) in 2022, seeking to catalyze $100 billion in financing, investment, and other support while supporting the deployment of 100 gigawatts of clean energy globally by 2035. The two governments have also launched initiatives to encourage, finance, and support clean energy investments in emerging economies and low-income countries (e.g., the U.S. Agency for International Development’s “Power Africa” initiative). The incoming Trump administration would do well to expand these initiatives, which have also benefited U.S. partners.

In Saudi Arabia, major U.S. companies have maintained a long presence in the kingdom’s hydrocarbons sector, including exploration, production, petrochemicals, technological support, and energy infrastructure. In the future, more opportunities will open for American companies in the kingdom’s effort to develop low-carbon products (e.g., providing technologies for capturing carbon). Aramco sees carbon capture, utilization, and storage (CCUS) as playing a major role in global efforts to cut emissions; toward that end, it is planning to build “one of the world’s largest CCUS hubs” in the Jubail industrial zone with partners that include the U.S.-based oil field services company SLB. Indeed, American firms are leaders in the development of this technology.

Such initiatives point to the general need for expanding U.S. collaboration on energy transition with both of these Gulf states—keeping in mind that this process will inevitably reshape the geopolitical map. Key areas of focus should include nuclear energy, carbon capture, hydrogen technologies, and security for energy transition supply chains. The UAE is reportedly exploring the option of building a second nuclear power facility in addition to Barakah, while Saudi Arabia hopes to export clean products that can enable the decarbonization of industries that are difficult to abate (e.g., iron and steel production). Ultimately, however, facilitating a full-scale energy transition and pursuing meaningful collaboration against climate change—which all parties recognize as a threat multiplier—will require Washington to continue working on the thorny prerequisite of regional stability.

Noam Raydan is a senior fellow at The Washington Institute and co-creator of its Maritime Spotlight series.