Part of a series: Maritime Spotlight

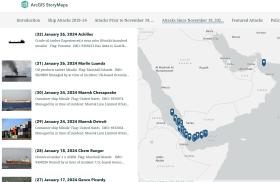

or see Part 1: Tracking Maritime Attacks in the Middle East Since 2019

While major operators will continue to avoid the Red Sea in 2025, others are launching new services in the high-risk waterway, including some that manage China-linked vessels.

On July 20, the Houthis attempted to attack the container ship Pumba (IMO 9302566) with an unmanned surface vehicle, claiming that the vessel was American. Security personnel on board were able to destroy the sea drone, and the ship, which was sailing from Jeddah, Saudi Arabia, continued its journey to Port Klang in Malaysia. In the following months, Pumba continued trading in the Red Sea, and data from MarineTraffic shows that on September 27 it crossed the Bab al-Mandab Strait on its way to China. This time, however, there was no Houthi attack.

The Liberia-flagged Pumba is managed by SeaLead Shipping, a Singapore-headquartered company, and does not have links to a U.S. company. In fact, SeaLead said in two separate statements earlier this year that the ships it operates in the Red Sea have no links to the United States, Britain, or Israel. SeaLead is also connected to another container ship, the Liberia-flagged Pinocchio (IMO 9400112), which the Houthis also wrongly labeled as an American ship when they launched two antiship ballistic missiles (ASBMs) toward it on March 11 without causing damage or injuries to the crew (see The Washington Institute maritime incident tracker). The vessel had past links to U.S.-based Oaktree Capital Management, one shipping database shows. On October 5, the Pinocchio, like the Pumba before it, safely crossed the Bab al-Mandab Strait coming from Jeddah on its way to Port Klang.

The Houthis have targeted several vessels based on inaccurate or outdated information. Maritime Spotlight tracking shows that some ships that were attacked based on incorrect ownership data have returned to trade in the region. These include vessels that carry Russian oil or are linked to Chinese companies (see this Maritime Spotlight). In September, Lloyd’s List Intelligence’s maritime risk analyst Bridget Diakun wrote that “growing certainty in vessel safety combined with the commercial incentive of a shorter and cheaper route” have incentivized some operators to profit from the Red Sea crisis.

Among the main operators that appear to be confident the Houthis will not target them are those managing China-associated ships. This data has been confirmed by Lloyd’s List Intelligence, and past tracking by Maritime Spotlight indicates the same. Although in March the Houthis targeted a China-linked crude oil tanker, Freda (IMO 9402469), the action was based on inaccurate information (see this Maritime Spotlight for more details).

SeaLead is among the companies that have continued to charter vessels to trade in the Red Sea despite attacks on at least two of its ships. Given that the Pumba and Pinocchio have recently sailed safely in the southern Red Sea with their automatic identification system (AIS) switched on, it appears likely the Houthis no longer believe the ships have a connection to the United States.

Not only has SeaLead continued existing shipping services, it has launched new ones. In late 2023, as the Houthis started attacking commercial vessels, SeaLead announced a shipping service connecting Red Sea ports in Saudi Arabia, Yemen, and Djibouti. Just last month, the company, which is active in the Middle East with an office in Dubai, also launched a new service connecting China, India, and Djibouti (see map below). Among the other vessels that SeaLead has operated in the Red Sea is the Liberia-flagged container ship Hakuna Matata (IMO 9354167), which is owned by a China-based company, according to two shipping databases and TradeWinds.

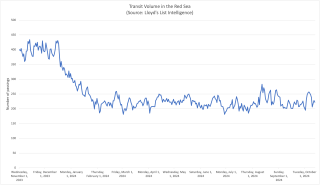

Transit through the Bab al-Mandab Strait last week was still down by more than 60 percent year-over-year, data from Lloyd’s List Intelligence shows. As the Houthis stepped up their attacks in the summer, particularly against crude oil tankers linked to Greek companies (see this Maritime Spotlight), several other companies were forced to avoid the region.

Meanwhile, giant liner operators are still taking the longer route around the Cape of Good Hope. Maersk and Hapag-Lloyd recently announced a new long-term operational collaboration, Gemini Cooperation, which is expected to kick off in February 2025. The shipping network, however, will avoid the Red Sea, and the fleet will continue to sail around southern Africa.

The trade patterns that have emerged since early 2024 due to the Houthi attacks are expected to remain until 2025 and even beyond. The precise trends will depend on the trajectories of the wars in Gaza and Lebanon, since the Houthis have linked their maritime campaign to both. While attacks in the southern Red Sea and the Gulf of Aden dropped in September and October compared to previous months, the region remains a very high-risk area for shipping. The Houthis even have the ability to expand their activities, particularly drone attacks, to the Arabian Sea and Indian Ocean.

View the maritime attack tracker here.