Amid Red Sea Crisis, Saudi Company Launches North Shipping Service

Part of a series: Maritime Spotlight

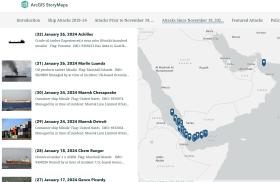

or see Part 1: Tracking Maritime Attacks in the Middle East Since 2019

Riyadh’s aim to become a global logistics hub connecting three continents will face challenges if risks to southern Red Sea shipping persist at their current levels.

Photo credit for main web image: @NEOMOxagon, posted on X (formerly Twitter), April 15, 2024, https://x.com/NEOMOxagon/status/1779799779230302424.

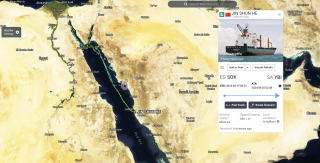

On April 9, 2024, the Chinese-flagged container ship Jin Shun He (IMO 9144316) left the Red Sea port of Jeddah, Saudi Arabia, and sailed north to the port of NEOM, according to shipping data from MarineTraffic. This particular ship deserves attention because of its inaugural role in an upgraded North Red Sea Express (NRX) service launched by Saudi Arabia’s Folk Maritime, a Red Sea container line newcomer, in partnership with the French shipping giant CMA CGM. While commercial shipping currently does not perceive risks in the northern Red Sea, the perils are high in the southern Red Sea, where Yemen’s Houthis continue to threaten merchant vessels, keeping several global companies away from the region.

In a March 21 press statement, CMA CGM remarked that the NRX connects the Jeddah port to NEOM and the northern Red Sea ports of Ain Sokhna (Egypt), Aqaba (Jordan), and Yanbu (Saudi Arabia), providing transshipment services. Folk Maritime, led by Poul Hestbaek, a former chief executive of the German container shipping line Hamburg Süd, describes itself as Saudi Arabia’s first independent feeder and short-sea shipping operator. “This service, in partnership with CMA-CGM, marks a significant step in enhancing Saudi Arabia’s capacity as a global logistics hub and reinforces our commitment to drive growth and connectivity within the maritime sector,” Hestbaek explained. According to the shipping news site TradeWinds, Folk Maritime—which was launched in February—has two additional feeder units that operate between Saudi Arabia, Jordan, and Egypt, and another ship for services between Jeddah and Sudan.

The Jin Shun He is owned, according to shipping data, by the China-based Fujian Zhonghang Shipping Company. TradeWinds reported in March that Folk Maritime had booked the container ship for a “10–12-month charter at $18,500 per day,” a high rate for vessels trading in the region and one attributable to the ongoing Houthi-led attacks.

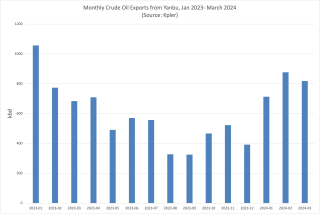

On April 13, the Jin Shun He left NEOM for Egypt’s Ain Sokhna before sailing to Jordan’s Aqaba. As of April 18, the container ship was traveling to the Red Sea port of Yanbu. In the past three months, Saudi Arabia boosted crude oil exports from Red Sea terminals amid increased Houthi attacks that forced even some crude oil tankers sailing from the Persian Gulf to take the long haul around southern Africa to reach Europe. Saudi crude oil exports from the Red Sea region rose from around 392,000 barrels per day in December 2023 to about 818,000 bpd in March 2024, shipping data from Kpler shows, and they remain strong so far in April. The majority of flows have gone to Ain Sokhna, thereafter, traveling northbound via the strategic Sumed pipeline to the Mediterranean terminal of Sidi Kerir, Egypt to be exported to global markets. While some vessels have been avoiding the southern Red Sea and Gulf of Aden, others continue to operate in the region including ships sailing to and from Saudi Red Sea ports.

Saudi Arabia’s aim to become a global logistics hub connecting three continents will require stability in the Red Sea and the region in general. Yet this aspiration will face challenges if current risks to shipping in the southern Red Sea are not reduced to a level that would restore confidence in the safety of navigation.

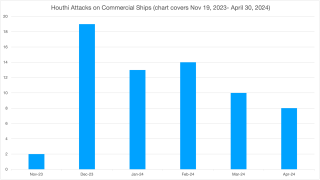

Since November 2023, more than fifty confirmed Houthi-led attacks have been conducted against commercial vessels—not including drone sightings, threats via Channel 16 which is used to make urgent and distress calls, or suspicious approaches. The attacks have involved missiles, drones, hijackings, and shots from small boats, targeting at least seven crude oil tankers, eleven oil product and chemical tankers, two car carriers, seventeen container ships, three general cargo ships, and seventeen bulk carriers.

Since January 12, when the United States and Britain launched strikes against military targets in Yemen, the creators of this database have recorded more than thirty attacks on commercial ships. So far in April, the frequency of attacks appears to have fallen compared to previous months.

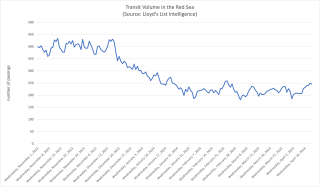

While data on active ships sailing in the Red Sea has fluctuated, Lloyd’s List Intelligence shows an increase during the week spanning April 8–14. The daily average for that week was around 235, up from 204 the previous week, according to Bridget Diakun, a data analyst at Lloyd’s List Intelligence—but far below the 392 measured a year earlier, April 10–16, 2023.

While the Houthis continue to target commercial ships, the frequency has changed (see chart above) with the advent of escorts by European and U.S./coalition warships. Even the sharp drop in active sailing vessels in the Red Sea that was evident in December and January amid panic in the shipping industry has eased. While some shipping companies continue to avoid the Gulf of Aden and the southern Red Sea, others are operating in the region, including CMA CGM, which toward the end of February resumed transit on a case-by-case basis.

Moreover, a sharp jump in observed maritime incidents involving interception of Houthi missiles and drones in the Red Sea and Gulf of Aden may—based on data collected so far—be followed by fewer incidents in April (to be confirmed once data is complete).

The Houthi-led maritime campaign has established high risks in the region that will not disappear immediately even in the event of a Hamas-Israel ceasefire. And even if the Houthis agreed to halt their attacks, they may pursue similar campaigns in the future in different political contexts—and with an even deeper impact. This would likely pose further challenges to regional countries including Saudi Arabia, along with their attempts at growth in transportation and logistics services. Such geopolitical risks may force them to calibrate their policies and even boost their defense systems to protect critical infrastructure.